TDS Refund Process Guide

Table of Contents

ToggleTDS refund

When you buy a house property with more than 50Lac, you need to deduct 1% TDS on the sale value or the RV value, whichever is higher, under Section 194-IA of the IT Act, 1961.

The TDS to be paid by the buyer on behalf of the seller through buyer Pan login using Form 26QB. TDS Refund situations may arise where excess TDS has been paid or TDS was paid in error or property sale execution was canceled. In such cases, the buyer can claim back the TDS paid as a TDS refund.

Types of TDS eligible for Refunds

1. TDS on Property Sale Section 194-IA

- Excess payment of TDS Deducted by mistake

- Property registration cancelled

2. TDS on NRI Payments Section 195

- Excess TDS Payments on the NRI property purchase

- Refunds are eligible when higher TDS is deducted by mistake, or due to Lower TDS or property registration got cancelled.

4. TDS on Agricultural Property Other than Commercial property

- Very rare case TDS on agricultural or inherited property sales, where TDS deduction was unnecessary but mistakenly applied.

Step 1: basic input for TDS refund

Before submitting for a TDS refund, first, we have to correct the 26QB property purchase details, then only can apply for the 26B refund process.

the following details:

- PAN card copy of the buyer and seller.

- Details of the property transaction, including agreement value and guidance value (RV).

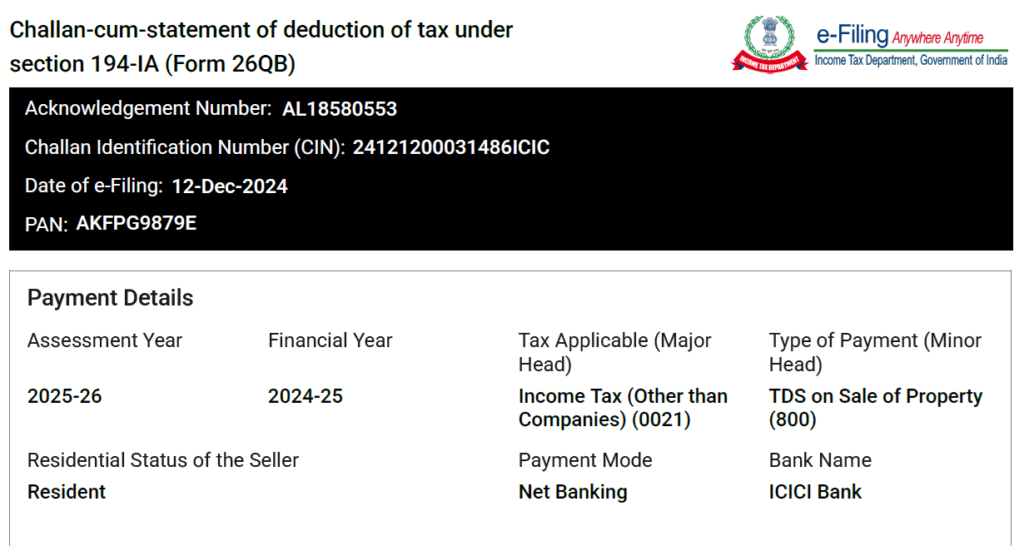

- Form 26QB acknowledgment number.

- Details of the TDS payment, including Challan Identification Number (CIN).

- Class 3 Digital Signature (DSC) registered on TRACES of the buyer

- contact details (email and phone number) for correspondence.

- Bank details update (at buyer’s income-tax PAN profile)

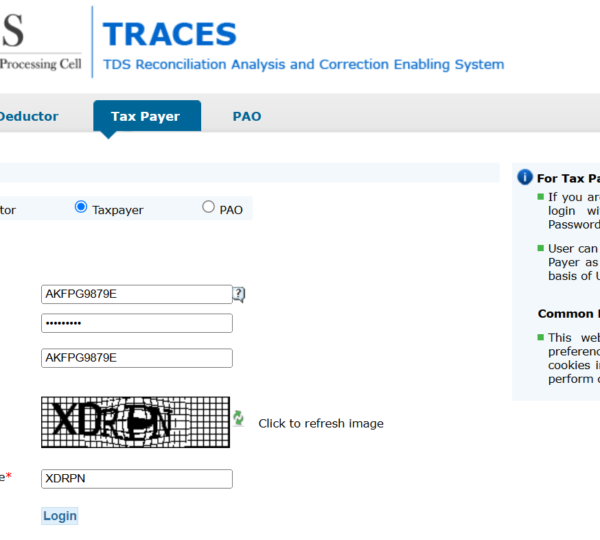

Step 2: Register at Traces by Buyer

- visit the Traces website, and register as Taxpayer

- after successfully entering as Taxpayer, the buyer will receive OTP on his mobile and email to authenticate the registration

- once registration done, he can able to login to TRACES

Login to TRACES

- Visit the TRACES website (https://www.tdscpc.gov.in)

- Log in using the buyer’s PAN as the User ID. and PW registered at Traces

- Complete the CAPTCHA and provide the password to access your account.

- update the class 3 Individual DSC of the buyer in the Traces profile tab

Step 3: Request for TDS Correction

- Visit the tab “Request for Correction” option under Statement/Forms.

- Select the Statement 26QB radio button for correction

- Fill the correction Form 26QB as per TDS reported

- Select the appropriate reason for correction (e.g., “Excess TDS Paid” or “Wrong TDS Deducted” or Others).

- no attach documents are required.

- Submit the request.

Step 4: Verification of Correction Request

- after submission for TDS correction, the request will require verification from the buyer’s DSC

- Upload the DSC to authenticate the correction request.

Step 5: Notify the Seller PAN for Approval

- The seller will receive a notification of the changes requested by the Buyer through their income tax portal.

- The seller must log in to his income tax account using his Pan as a user ID and approve the correction request under the option for your Action.

Step 6: Communicate to the Assessing Officer (AO)

After your correction request is filed & seller approval is complete:

- You can reach out personally to the Assessing Officer (AO) in your jurisdiction to seek final approval.

- Provide the following to the AO:

- Proof of excess payment or error.

- Revised TDS computation details.

- Supporting documents such as Form 26QB, agreement copy, and payment proof.

- Any other details as requested by AO

Important Note:

- The AO will assess whether there is any undervalue of the property or tax avoidance or pending tax liabilities with the buyer’s Pan account.

- If additional tax is due, you may be required to pay it before the AO approves the refund.

- You have to visit AO office accompanied by the seller of the property

Step 6: TDS Refund Processing

- Once the correction request is approved by AO, the TRACES portal enables you to apply for TDS refund using form 26B.

- In 26B, enter the TDS paid challan details and view the unconsumed amount.

- then, the unconsumed TDS is eligible for a Refund at TRACES to credit the amount to the buyer’s bank account.

- Monitor the refund status through the TRACES dashboard.

- Ensure that all details in Form 26QB are accurate before filing.

- Keep a copy of all communications and supporting documents for future reference.

If the correction is not approved or delayed, consider seeking professional assistance for further representation before the Income Tax Department (TDS department).

This complete guide on the TDS refund to the buyer’s account can be done by proper systematic process at TRACES and follow-up with AO is essential to get the TDS Refund. For further clarification or assistance in getting your TDS refund, you can reach out to Prakasha & Co., a leading legal and tax advisory service provider.

TDS Refund Contact at:

Prakasha & Co.,

Address: #17/2, 2nd Flr, near Chairman club, SahakarNagar, Bengaluru-560092, Phone: 07019827351

Case Study: Successful TDS Refund

Background:

Our client, Mr. Mahesh BR, recently purchased a house in Bangalore for ₹48 Lakhs. Before the property registration, he was mistakenly informed that the guidance value (RV value) of the property was ₹61,16,000, leading him to pay 1% TDS of ₹61,160. However, on the day of registration (13th December 2024), Mr. Mahesh BR confirmed that the correct guidance value was actually ₹47 Lakhs, below the ₹50 Lakh threshold for TDS applicability.

So he realized the excess TDS payment and approached us to help him claim TDS refund.

Process for TDS Refund

- Initial Assessment:

- We took the details of the sale transaction and identified the TDS error

- Agreed upon the fees for the process of the TDS refund,

- Verified Mahesh’s Income Tax profile to confirm there were no pending tax demands.

- Collected hardcopy from Mr. Mahesh to prepare the request to AO:

- Form 26QB receipt

- Property sale agreement and registration papers.

- Bank challan and payment proof of the TDS

- Registered Class 3 DSC (Digital Signature).

- Guidance value report from Kavery online

- TDS Filing on TRACES:

- On 16th December 2024, we filed the correction request for the excess TDS paid

- And asked Seller of the property to approve the same in his PAN login

- Approaching the Assessing Officer (AO):

- Advised Mr. Mahesh and the seller to visit the Assessing Officer (AO) at HMT Bhavan, RT Nagar Bangalore (the jurisdictional AO). To get the approval

- We accompanied Mr. Mahesh and explained the AO of the discrepancy and present the necessary documents.

- After reviewing, the AO approved the correction request.

- TDS Refund Processed:

- after approval, the corrected records were updated in Form 26AS of the seller.

- The TDS refund of ₹61,160 was credited to Mr. Mahesh’s bank on 20th December 2024.

Key Takeaways on the TDS Payment

- Always cross-check the guidance value (RV) before doing TDS.

- Mistakes in TDS payments can be corrected with the help of proper process.

- Addressing errors on time helps avoid capital gain tax during tax filings for both buyer and seller.

Why Choose Prakasha & Co.?

At Prakasha & Co., we have expertise in TDS refunds, we handle TDS filing on TRACES to take follow up with Assessing Officers.

If you’ve faced a similar situation, please contact us. We’ll help you get a refund of your hard-earned TDS money.

Contact TDS refund

07019827351 crp@prakashaandco.com, Sahakarnagar Bangalore 560092

Like Us On Facebook

Our Client's Review

EXCELLENTTrustindex verifies that the original source of the review is Google. Best place to file ur GST n IT returns .. They respond quickly, communicate well and get ur work done as per ur needs in a very short time ..Posted onTrustindex verifies that the original source of the review is Google. Best place for Income tax filingPosted onTrustindex verifies that the original source of the review is Google. Of all the CA, CS teams I have interacted with, they are the most prompt and organized. I have taken their services for almost 3 years now for various things like income tax queries, income tax filing, networth certificates, and compliance certificates. They always display a clear understanding of the law and are also able to explain it to you in layman terms. Overall a very resourceful and courteous team. Thank you for the support!Posted onTrustindex verifies that the original source of the review is Google. Best company secretary I bangalore ever seen such quick quality servicePosted onTrustindex verifies that the original source of the review is Google. Prakasha & Co has been a lifesaver for me when it comes to my tax dispute and filings with IT office. They are always very responsive and helpful whenever I have any questions or issues, I recently had an issue with my sister business GST filings, and they were able to quickly identify the issue and help me resolve it. They really go above and beyond to make sure their clients are taken care of.Posted onTrustindex verifies that the original source of the review is Google. ''The team at Prakasha& Co made sure my company was compliant with all the legal requirements. Their attention to detail and timely response was truly remarkable."Posted onTrustindex verifies that the original source of the review is Google. "I was impressed with the level of customer service provided by Prakasha& Co. They were always available to answer my questions and provide guidance throughout the company registration process."

Important Links

- Top 10 GST Registration Consultants in Bangalore

- Top 10 Best Income Tax Lawyers in Bangalore

- Top 10 Trademark Registration Consultants in Bangalore

- GST Registration in Bangalore

- Private Limited Company Registration in Bangalore

- Partnership Firm Registration in Bangalore

- Proprietorship Registration in Bangalore

- Trademark Registration in Bangalore

- Audit Frim in Bangalore

- CA Firm in Bangalore

- Accounting Services in Bangalore

- GST Lawyers in Bangalore

- Payroll Services Provider in Bangalore

- Payroll Consultant in Bangalore

- Income Tax Lawyer in Bangalore

All Categories

- Audit

- Blogs

- Bookkeeping Services

- Company Registration

- Company secretary Legal & Chartered Accountant

- Digital Signature Certificate (DSC) Services

- FSSAI Registration and Consultation

- GST

- Income tax

- Partnership Firm Registration

- Payroll Services

- Risk Management Services

- Startup Registration Process

- Trademark Registration

- Uncategorized