Alteration of MOA & MOA Amendment

Table of Contents

ToggleWhy Alteration in MOA is Important

Many time companies wants to enter into new fields, to stay relevant and grow. One such strategic move is to change or expand the business objectives defined in the Memorandum of Association (MoA). This process, while legally permitted, involves a series of legal, and regulatory compliances that must be approached with precision and clarity.

Imagine a scenario where ABC Pvt Ltd, a software company, specializes in creating applications solutions. Over time, the company evolves and begins to develop a investment-tech platform—a algo trading to manage investments in shares, derivatives, and other financial instruments.

However, there’s a regulatory checkpoint: since the existing MOA only permits software services, it does not permit in investment or trading activities, even if for internal testing. To remain compliant with the Co Act, 2013, ABC Pvt Ltd must amend its MOA—object clause—to reflect the new business.

📌 What Is MOA Alteration?

The MOA is a main document, that shows what is the main business activity of this company. Altering the MOA means changing the activity which is legally allowed to carry the business.

🗂️ When Should a Company Change Its Object?

- Entering into new business activity areas

- Development of in-house platforms for specific purposes

- Shifting from one sector (IT) to another (finance, consulting, etc.)

- Alignment with investor/business partner expectations

- Regulatory restructuring or repositioning

📋 Step-by-Step Process to Change the Object

- Board Meeting

- Prepare a note of the new business to undertake.

- Pass a Board Resolution approving the proposed new business.

- Fix date, time, and venue for the Extraordinary General Meeting (EGM).

- Authorize a Director to send notice of EGM.

- Notice of EGM

- Prepare the EGM notice with an explanatory statement under Section 102.

- If calling at shorter notice, obtain 100% consent from shareholders.

- Shareholders’ Meeting

- Hold the EGM and pass a Special Resolution (minimum 75% votes in favour).

- Ensure the MoA is updated with the new business object clause.

- Add a footnote referencing the Board Resolution number and EGM date.

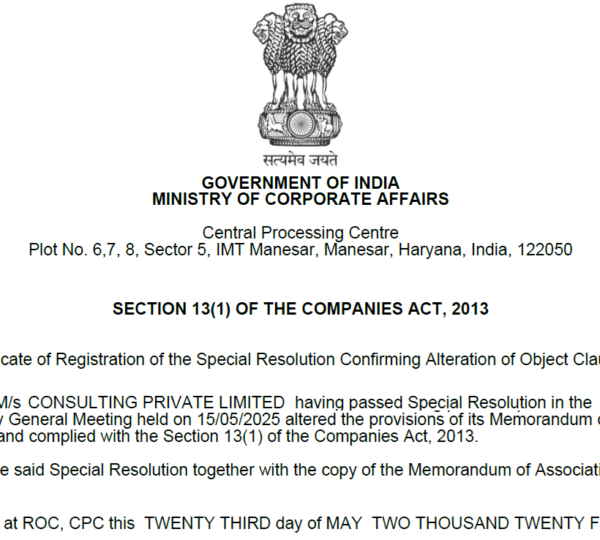

- Filing with ROC

- File Form MGT-14 within 30 days of passing the resolution.

- Attach the following:

- Certified copy of Special Resolution

- EGM Notice & Explanatory Statement

- Altered MoA in pdf format (clean and signed by director)

- Old subscriber sheet

- Consent letters for shorter notice (if applicable)

✅ Additional Documents Required

few critical documents (especially when moving sectors) is:

🔒 Affidavit under Rule 12 of Companies (Incorporation) Rules, 2014

This affidavit is to be executed on stamp paper and notarized, declaring that:

- The company shall not engage in highly regulated activities (like SEBI, RBI, IRDA, etc.) without prior approvals.

- The revised object is intended for internal/proprietary use only (in cases like investment using a self-developed IT platform).

🛑 Common Issues in Object Change

⚠️ Sector Change or NIC Code Misalignment

- The new object clause must align with the correct NIC code.

- Avoid wide wording that covers multiple sectors (e.g., IT and Finance in the same clause).

- Choose a specific NIC code like 62099 for IT or 64990 for financial services.

⚠️ Drafting Errors in MOA

- Object clauses should be concise, specific, and clear.

- Avoid “catch-all” language that invites rejection or regulator involvement.

- Add a footnote in the MOA:

“This object clause was inserted vide Board Resolution No. [xxx] dated [xx/xx/20xx] and confirmed in the EGM held on [xx/xx/20xx] in accordance with Section 13 of the Companies Act, 2013.”

⚠️ Improper Attachments

- Upload only legible, signed, and scanned pdf documents.

- Ensure Digital Signature Certificate (DSC) of the director is properly role-checked in MCA.

✅ Moa Alteration Checklist

| Document | Status |

| Board Resolution (BR) | ✅ Required |

| EGM Notice | ✅ Required |

| Special Resolution Copy | ✅ Required |

| Updated MOA with footnote | ✅ Required |

| Affidavit under Rule 12 (if changing sector) | ✅ Required |

| Proper NIC Code mentioned in MGT-14 | ✅ Mandatory |

| Shorter notice consent (if applicable) | ✅ Required |

| DSC of authorized director (role-checked) | ✅ Must be active in MCA V3 |

🕒 Timeline for Object Change

| Step | Timeline |

| Board Meeting | Day 1 |

| Shareholder EGM | Within 7–15 days |

| Filing MGT-14 | Within 30 days of EGM |

| ROC Approval | Usually 3–10 working days post-resubmission |

💰 Cost Involved

| Particulars | Approximate Cost (INR) |

| Professional Fees (CS/CA/Lawyer) | ₹5,000 – ₹15,000 |

| MCA Filing Fees (based on capital) | ₹500 – ₹5,000 |

| Stamp Paper (Affidavit) | ₹100 – ₹300 |

| Notarization | ₹100 – ₹300 |

🧠 Expert Advice from Prakasha & Co.

At Prakasha & Co., we strongly recommend:

- Carefully drafting the new object clause to avoid sectoral approvals.

- Reviewing whether any part of the object could be interpreted as financial service.

- Including clear declarations and affidavits in borderline cases like investment in securities, trading, AI-fintech models, etc.

- Notifying PAN, GST, and bank authorities post-approval, if the business change is substantial.

✅ MOA Change is Strategic—but Must Be Legally correct

Changing your company’s business activities is not merely a formality—it’s a corporate restructuring action with legal implications. Whether you’re moving into fintech, manufacturing, education, or e-commerce, the alteration must be:

- Well-planned

- Properly worded

- Legally supported

- Filed with the correct NIC codes and affidavits

For end-to-end assistance in MOA alteration, MCA filings, and business transition, connect with:

📞 Contact Us

Prakasha & Co.

Chartered Accountants | Company Secretaries | Legal Advisors

📍 No 17/2, 2nd Floor, Sahakarnagar, Bangalore – 560092

🌐 www.prakashaandco.com

📧 Email: crp@prakashaandco.com, 📞 Phone: +91 70198 27351

Like Us On Facebook

Our Client's Review

EXCELLENTTrustindex verifies that the original source of the review is Google. Best place to file ur GST n IT returns .. They respond quickly, communicate well and get ur work done as per ur needs in a very short time ..Trustindex verifies that the original source of the review is Google. Best place for Income tax filingTrustindex verifies that the original source of the review is Google. Of all the CA, CS teams I have interacted with, they are the most prompt and organized. I have taken their services for almost 3 years now for various things like income tax queries, income tax filing, networth certificates, and compliance certificates. They always display a clear understanding of the law and are also able to explain it to you in layman terms. Overall a very resourceful and courteous team. Thank you for the support!Trustindex verifies that the original source of the review is Google. Best company secretary I bangalore ever seen such quick quality serviceTrustindex verifies that the original source of the review is Google. Prakasha & Co has been a lifesaver for me when it comes to my tax dispute and filings with IT office. They are always very responsive and helpful whenever I have any questions or issues, I recently had an issue with my sister business GST filings, and they were able to quickly identify the issue and help me resolve it. They really go above and beyond to make sure their clients are taken care of.Trustindex verifies that the original source of the review is Google. ''The team at Prakasha& Co made sure my company was compliant with all the legal requirements. Their attention to detail and timely response was truly remarkable."Trustindex verifies that the original source of the review is Google. "I was impressed with the level of customer service provided by Prakasha& Co. They were always available to answer my questions and provide guidance throughout the company registration process."

Important Links

- Top 10 GST Registration Consultants in Bangalore

- Top 10 Best Income Tax Lawyers in Bangalore

- Top 10 Trademark Registration Consultants in Bangalore

- GST Registration in Bangalore

- Private Limited Company Registration in Bangalore

- Partnership Firm Registration in Bangalore

- Proprietorship Registration in Bangalore

- Trademark Registration in Bangalore

- Audit Frim in Bangalore

- CA Firm in Bangalore

- Accounting Services in Bangalore

- GST Lawyers in Bangalore

- Payroll Services Provider in Bangalore

- Payroll Consultant in Bangalore

- Income Tax Lawyer in Bangalore

All Categories

- Audit

- Blogs

- Bookkeeping Services

- Company Registration

- Company secretary Legal & Chartered Accountant

- Digital Signature Certificate (DSC) Services

- FSSAI Registration and Consultation

- GST

- Income tax

- Partnership Firm Registration

- Payroll Services

- Risk Management Services

- Startup Registration Process

- Trademark Registration

- Uncategorized