How to File Income Tax Returns Online in 2024

How to File Income Tax Returns Online in 2024– The Interim Budget 2024 was presented by Finance Minister Nirmala Sitharaman. So far there have been no changes experienced in the tax filing. The income tax slabs and the charges remain unchanged for the present year. The income tax is liable from 1st April 2024; therefore, the public must analyze the charges between the new and the old tax rates.

Although there were some basic amendments announced for the 2024-2025 financial year, Income tax slabs were revised this year. Previously the basic line to pay the tax was Rs 2.5 lakh but now it is revised to Rs 3 Lakh. Now the taxes are auto debited from the pay. You can choose the previous tax slabs. A standard deduction of Rs 50,000 is expected from the salaried and pensioner community of India. If you have to file the income tax when your annual is Rs 7 lakh then a question arises How to File Income Tax Returns Online in 2024?

Prakasha & Co. is a group of experienced lawyers aware of the new income tax laws. We will help you on How to File Income Tax Returns Online in 2024 with our expertise. You can contact us at +91 7019 827 351 or write an email at crp@prakashaandco.com.

Table of Contents

ToggleWhat is an Income Tax Return?

Before understanding How to File Income Tax Returns Online in 2024, let us dive into what is an Income Tax Return.

The ITR or the Income Tax Return is a form an individual needs to submit to the Income Tax Department of India. The information provided in the form about the income should be from the start of the financial year till the end of it (1st April- 31st March).

The income tax includes various forms of income such as the income from salary, the profits from the business, capital gain, income generated from the property, etc.

The income Tax department has described the tax into seven types, ITR 1, ITR 2, IT3, ITR 4, ITR 5, ITR 6, and ITR 7.

The new tax filing charges are:

| Income tax slabs (Rs) | Income tax rate (%) |

| From 0 to 3,00,000 | 0 |

| From 3,00,001 to 6,00,000 | 5 |

| From 6,00,001 to 9,00,000 | 10 |

| From 9,00,001 to 12,00,000 | 15 |

| From 12,00,001 to 15,00,000 | 20 |

| From 15,00,001 and above | 30 |

For every individual, it is compulsory to file the tax appropriately within the tax standards. Many times we confuse income tax with the ITR but instead, the tax is the amount paid over the financial year’s earnings. The ITR is the record you need to provide to the government about your income, tax liability, and tax paid.

How to File Income Tax Returns Online in 2024?

Let Prakasha and Co. be your guide for details!

We are the best tax consultant in Bangalore and with over 15 years of experience, we have managed to provide expertise in income tax filing to over 500+ clients.

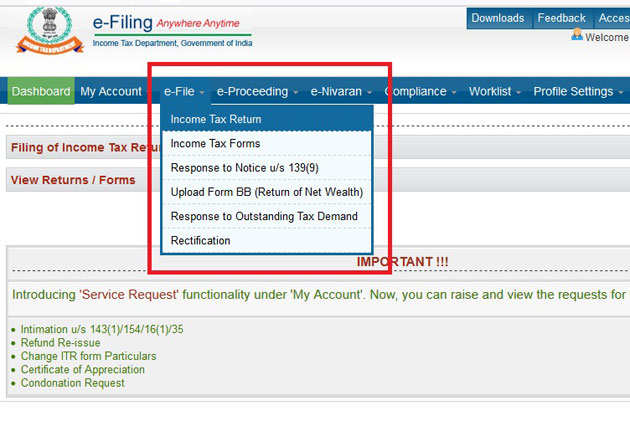

Digitalization is on its peak and many are concerned about How to File Income Tax Returns Online in 2024. Here is a step-by-step guide.

For the online portal, you need to begin with the following steps.

- Login in the income tax for the e-filing portal.

- Start by filling in the details as asked on the pages.

- The information you fill in needs to be correct, it helps reduce the chances of the malfunctioning of the form.

Suggesting the best you can consult the experts of Prakasha and Co. and plan to commence the online tax filing. We are aware of what information is suitable and needs to be mentioned in the form property.

Benefits of Filing the Tax Online

Electronic filing or Online filing has been supporting the income tax filing candidates for years. There is electronic software that is supported by the relevant tax authority through which the candidates file the tax. E-filling is gaining impressive popularity among candidates because of its benefits and easy-to-go method.

- Income tax filing is a much easier and a flexible thing. Because of the online process, you have to file it in your 9 to 5 and from home. It saves a lot of time You can file the tax whenever you need and require.

- There is no paper required when you choose the e-filing option because your data is directly transferred to the tax agency. It is also a time-saving and a cost-saving process. Prakasha and Co. can help you will the service.

- The accuracy of the details is higher in the e-filing process than in the paper. You can crosse check and immediately change anything if required which is technically not possible in the paper filing process.

Consulate Prakasha and Co.

Prakasha and Co. is a top-notch tax-filing company in India. We can reduce your financial burden and guide you through the means of How to File Income Tax Returns Online in 2024. Our expert can reduce your tax pay by offering the solution.

Apart from the tax filing services we also deal in GST trademark registration, Import Export Registration, Shop Establishment registration, etc.

To know more, contact us at the following.

Call- +91 7019 827 351

Email- crp@prakashaandco.com

Like Us On Facebook

Our Client's Review

EXCELLENTTrustindex verifies that the original source of the review is Google. Best place to file ur GST n IT returns .. They respond quickly, communicate well and get ur work done as per ur needs in a very short time ..Posted onTrustindex verifies that the original source of the review is Google. Best place for Income tax filingPosted onTrustindex verifies that the original source of the review is Google. Of all the CA, CS teams I have interacted with, they are the most prompt and organized. I have taken their services for almost 3 years now for various things like income tax queries, income tax filing, networth certificates, and compliance certificates. They always display a clear understanding of the law and are also able to explain it to you in layman terms. Overall a very resourceful and courteous team. Thank you for the support!Posted onTrustindex verifies that the original source of the review is Google. Best company secretary I bangalore ever seen such quick quality servicePosted onTrustindex verifies that the original source of the review is Google. Prakasha & Co has been a lifesaver for me when it comes to my tax dispute and filings with IT office. They are always very responsive and helpful whenever I have any questions or issues, I recently had an issue with my sister business GST filings, and they were able to quickly identify the issue and help me resolve it. They really go above and beyond to make sure their clients are taken care of.Posted onTrustindex verifies that the original source of the review is Google. ''The team at Prakasha& Co made sure my company was compliant with all the legal requirements. Their attention to detail and timely response was truly remarkable."Posted onTrustindex verifies that the original source of the review is Google. "I was impressed with the level of customer service provided by Prakasha& Co. They were always available to answer my questions and provide guidance throughout the company registration process."

Important Links

- Top 10 GST Registration Consultants in Bangalore

- Top 10 Best Income Tax Lawyers in Bangalore

- Top 10 Trademark Registration Consultants in Bangalore

- GST Registration in Bangalore

- Private Limited Company Registration in Bangalore

- Partnership Firm Registration in Bangalore

- Proprietorship Registration in Bangalore

- Trademark Registration in Bangalore

- Audit Frim in Bangalore

- CA Firm in Bangalore

- Accounting Services in Bangalore

- GST Lawyers in Bangalore

- Payroll Services Provider in Bangalore

- Payroll Consultant in Bangalore

- Income Tax Lawyer in Bangalore

All Categories

- Audit

- Blogs

- Bookkeeping Services

- Company Registration

- Company secretary Legal & Chartered Accountant

- Digital Signature Certificate (DSC) Services

- FSSAI Registration and Consultation

- GST

- Income tax

- Partnership Firm Registration

- Payroll Services

- Risk Management Services

- Startup Registration Process

- Trademark Registration

- Uncategorized