Simple Guide to Lower Deduction Certificate

Table of Contents

ToggleLower Deduction Certificate

In the complex system of tax rules, the Lower Deduction Certificate (LDC) is a cash cow for taxpayers, especially for those seeking low tax rate. Under Section 197 of the Income Tax Act, 1961, taxpayers can apply for lower TDS rate by using Form 13.What is a Lower Deduction Certificate?

A Lower Deduction Certificate, also known as a lower TDS certificate, allows taxpayers to reduce the rate of tax (TDS) on their income. It is particularly useful for taxpayers who expect their final tax liability to be lower than the standard TDS rate.Who Benefits from a Lower Deduction Certificate?

- Individuals or Businesses with substantial advance tax credits.

- Non-Residents (NRIs) selling property or earning income in India to avoid high TDS deductions.

- Taxpayers whose income falls within thresholds where standard deductions might exceed actual tax liability.

Why Should You Apply for a Lower Deduction Certificate?

Excessive TDS deductions can lead to liquidity issues and delayed tax refunds. Applying for an LDC helps you:- Avoid excess TDS deductions on your income.

- Maintain better cash flow for immediate financial needs.

- Reduce dependence on the refund claims after filing ITR.

TRACES Application through Form 13

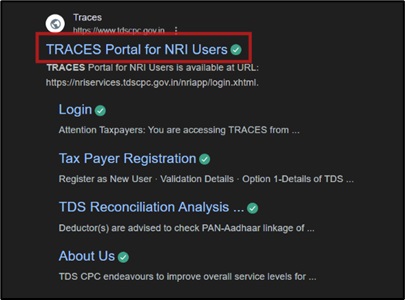

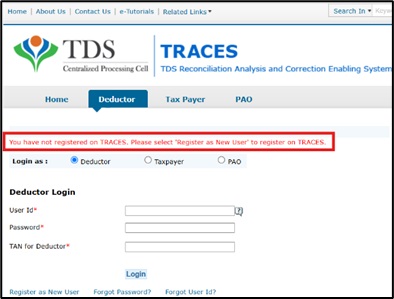

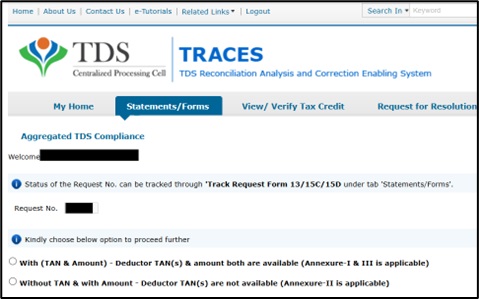

The application for a lower TDS rate or exemption is made using Form 13, submitted via the Income Tax Department’s TRACES portal. The Income Tax Department provides an online service called Traces (TDS Reconciliation Analysis and Correction Enabling System) at www.tdscpc.gov.in This tool helps both those who pay and those who deduct TDS to easily view and match their TDS payments. It’s designed to make the process of filing returns and requesting refunds more straightforward.

Step-by-Step Guide to Getting a Lower Deduction Certificate

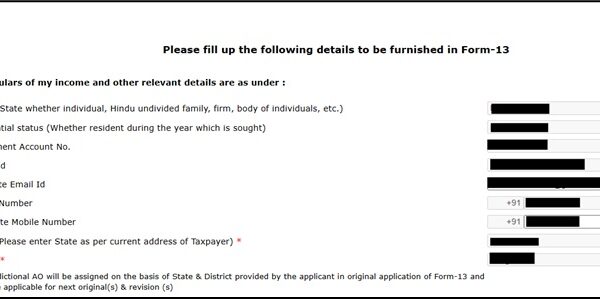

- Basic Information Filling

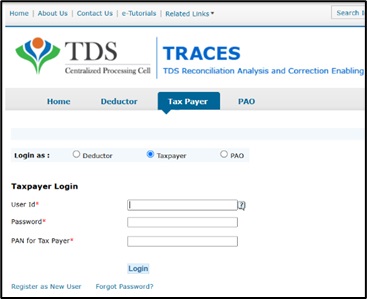

- Login to the TRACES website using your PAN credentials or create an account first if you are a new user.

- Select the option of “Tax Payer” for login purpose.

-

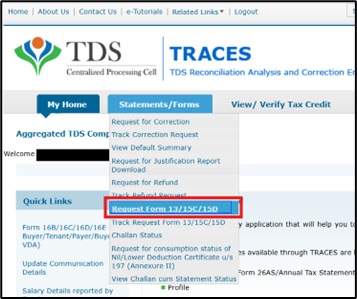

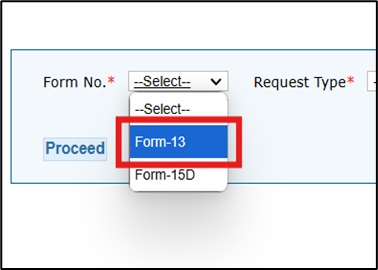

- Navigate to Form 13 under the “Lower/No Deduction Certificate” section.

-

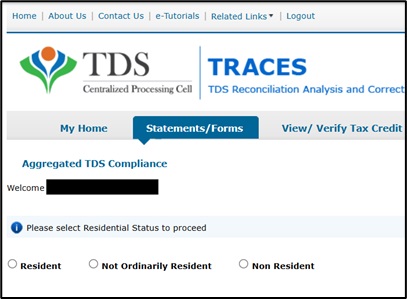

- Select the right option according to your residential status. For Example, an NRI would choose the option of “Non-Resident”.

-

- Fill in the personal details, income heads, and expected tax computation for the financial year.

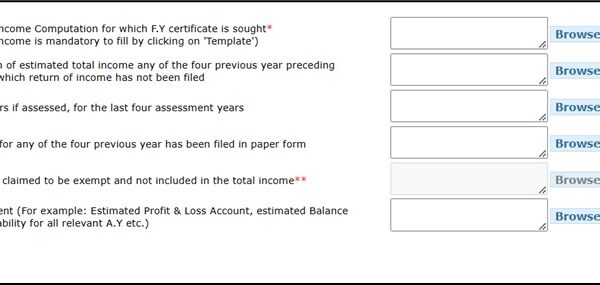

- Lower Rate Request

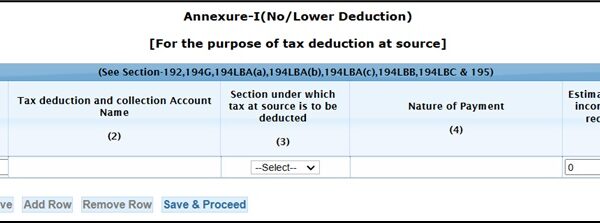

- Specify the nature of income and TDS sections applicable.

- Provide detailed calculations to support your request for a reduced TDS rate.

-

Attachments and Documentation for form 13

Upload supporting documents such as:- Copies of ITR filings for the past 5 years.

- Computation of expected income and liability.

- Relevant agreements or sale deeds (for both purchase and sale transactions).

- Guidance Value of the property.

- Property purchase payment proof.

- Copy of Passport (for NRIs)

- Tax residency certificate (for NRIs)

- Copy of 26AS Document if applicable

There is no standard practice from AO while process of lower TDS, he may ask:So it’s always advise you to, take guidance from expert, before process of Lower TDS.

- Request Letter mention the reason for seeking a lower TDS rate, supported by facts and provisions under the Income-Tax Act.

- Flat/Unit Allotment Letter from the builder confirming details like unit number, agreement date, and consideration value etc.

- Case Precedence that support the lower TDS rate application.

- Final Submission

- Review the application thoroughly.

- Submit the form and keep the acknowledgment number for tracking

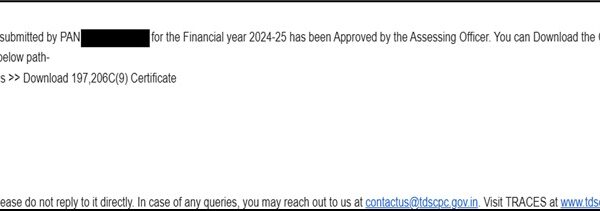

- You would receive a confirmation mail with a link for downloading the certificate.

- Download Certificate

-

- Select the download option in the menu bar.

- Choose the appropriate options according to the section suitable.

- Choose the correct financial year according to the requirement & enter the pan details.

How to apply online? watch the Video on TDS Lower rate

Common mistakes while applying

- People not having a PAN Card cannot file for lower deduction certificate.

- While applying for TDS it automatically chooses the option of “Deductor”, you need to choose the appropriate option whichever is applicable in your case.

- Selecting the right Form is very vital.

- While selecting the type of annexure, you must know that Annexure 1 must be selected when the applicant is the seller and vice-versa.

- You must know the calculation of Rate of Deduction (Short term Gain: 20%, Long term gain: 12.5%)

- While entering TAN Number make sure that the PAN Number and the TAN number are not of the same person (in same row).

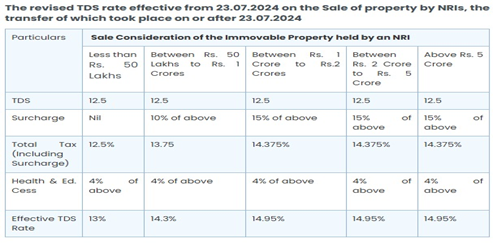

Revised TDS rate on the property sale by NRI wef from 23 July 2024

the revised Tds for NRI, is as follows. the sale value up to 50Lac, then the TDS rate is 13% (12.5% plus Cess at 4%) the sale value 50 Lac to 1 Crore, the TDS rate is 14.3% (12.5% + Surcharge 10% +Cess 4%) the sale value more than 1 crore, the TDS rate is 14.95% (12.5% + Surcharge 15% +Cess 4%)

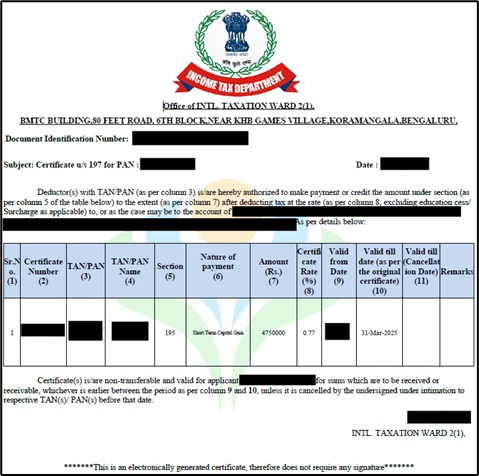

How Does a Lower Deduction Certificate Look?

Once approved, the Lower Deduction Certificate issued by the Income Tax Officer will contain:- Name and PAN of the applicant.

- Nature of income and applicable section (e.g., Section 194IA for property sale).

- Approved lower TDS rate (e.g., 0% or 5%).

- Certificate validity (financial year-specific).

Clarification regarding Lower TDS Certificate:

The turnaround time (TAT) for reviewing the application is around 30 days. The applicant would receive an email regarding the acceptance or rejection of their application. The rejection could be for multiple reasons like wrong computation, error in the documentation or incorrect rate of deduction mentioned etc. The reason for rejection is always mentioned in the email. For any kinds of clarification or queries, try contacting the income tax office or contact Prakasha and Co, from Team IN Filings who will be happy to assist you.How Prakasha And Co. Can Help

At Prakasha And Co., we provide end-to-end support for obtaining Lower Deduction Certificates. Our Process- Initial Consultation

- We assess your eligibility for reduced TDS and gather the required information.

- Document Preparation

- Our experts organize and review all necessary documents, ensuring compliance with Income Tax rules.

- Form 13 Filing

- We prepare and submit your application on the TRACES portal, navigating through each stage seamlessly.

- Follow-Up and Representation

- We handle communication with the tax authorities and provide clarifications if needed.

- Certificate Delivery

- Upon approval, we provide the certificate and guide you on its usage.

Documents Required for Applying Form 13

When working with Prakasha And Co, we ensure a seamless process by collecting and preparing the necessary documents:- PAN and Aadhaar of the applicant.

- Past Income Tax Returns (ITR) and computation of total income.

- Agreements/contracts related to the income (e.g., sale deeds).

- Tax residency certificates (for NRIs).

- Expertise in NRI TDS Matters: We have extensive experience handling property sales and income tax issues for NRIs.

- Customized for NRI: For NRIs, we specialize in obtaining TRC, managing DTAA benefits, and addressing cross-border tax compliance.

- Hassle-Free Process: We ensure end-to-end service, from filing Form 13 to certificate issuance.

- Timely Updates: We provide regular updates on the application status and next steps.

- Affordable Pricing: Transparent and competitive pricing with no hidden costs.

Checklist for Lower TDS Rate Application

When applying for a Lower Deduction Certificate (LDC) under Section 197 of the Income Tax Act, gathering and submitting accurate documentation is critical for a smooth approval process. Below is a checklist that outlines key documents and information required for the application, including their relevance.- Property Transaction Details

- Guidance Value of Property: Ensure the guidance value (per square meter) is accurate and documented as per local property valuation norms, as a proof the guidance value, Kavery online valuation of the property to be attached. ref:- https://www.kaveri.karnataka.gov.in/

- Advance Payments: Provide details of any advances received from the buyer, including:

- Transaction Date

- Amount Received

- Mode of Payment (Bank Transfer, Cheque, DD)

- Transaction ID

- Residential Status of the Applicant

- Travel Details: Maintain a record of arrivals and departures from India (with dates, places, and travel history).

- Copy of Passport: Ensure all pages with entry/exit stamps are clear and legible to validate residential status for the financial year.

- Declaration of Rental Income (If Applicable)

- Clearly state whether the property in question has been rented out in previous years.

- If no rental income was generated, provide a declaration stating the same.

- Previous Income Tax Records

- Submit the copies of ITR filings for 5 preceding previous years, that shows the historical income and tax liabilities.

- Submit the Tax computation statement for the ongoing financial year, and support the request for lower TDS.

- Agreement/ MOU Details

- The applicant also needs to submit a copy of the Sale Agreement or Memorandum of Understanding (MOU) regarding the property transactions.

- If any amendments/ adjustment exists add those too.

- NRI-Specific Documentation

- Tax Residency Certificate (TRC) from the country of their residence.

- Declaration under Section 90/90A for availing benefits under the DTAA (Double Taxation Avoidance Agreement).

- Mode of Filing

FAQs on Lower TDS Rate Certificate (Section 197)

To help you understand the Lower TDS Rate Certificate (LDC) better, we’ve compiled answers to some of the most frequently asked questions:- What is a Lower TDS Rate Certificate?

- Who can apply for a Lower TDS Rate Certificate?

- Residents: For the income from salaries, rent, or professional services.

- Non-Residents (NRIs): For income from sale of property, interest, or other taxable earnings in India.

- How much TDS rate reduction can I expect?

- It can range from 0% (complete exemption) to a rate lower than the actual standard deduction specified for your income type.

- For example, an NRI who sells his property may get a reduced rate of 5% or less, instead of the standard rate of 20% or 30%.

- How do I apply for a Lower TDS Rate Certificate?

- How long does it take to get the certificate?

- Standard Cases: 2 to 4 weeks.

- Complex or NRI Cases: 4 to 6 weeks or more.

- What are the documents required for the application?

- PAN card and Aadhaar card (for normal residents).

- Passport and tax residency certificate (for NRIs).

- The copies of previous years’ ITR filings.

- Sale agreements or contracts, if applicable (generally for sale or purchase of property).

- Projected income and tax computation for the current financial year.

- Is the certificate valid for multiple transactions as well?

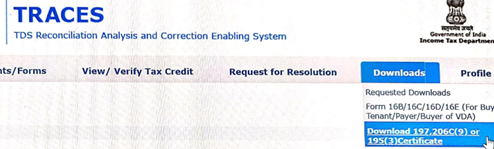

7A. How to download the Lower TDS certificate?

You can download from traces website, using login id and password, under the tab, downloads, download 197,206C (9) or 195(3) Certificate

- Does obtaining the certificate guarantee no TDS deduction?

- Can NRIs benefit from a Lower TDS Rate Certificate?

- Property Sales: Avoiding the standard TDS rate of 20% on long-term capital gains or 30% on short-term capital gains.

- Interest Income: Reducing TDS on interest earned from NRO accounts.

- What happens if I don’t apply for the Certificate?

- The payer (Deductor) will deduct TDS at the standard rates.

- You might need to claim a refund later by filing your ITR, which could delay access to funds.

- Can I apply for a certificate in the middle of a year?

- How does Prakasha And Co help with the process?

- Assessing a person’s eligibility and preparing the documents.

- Filing Form 13 in the TRACES portal.

- meeting with the Assessing officer to explain and get the approval done with timely follow-up.

- take followup call with AO, submit the pending things if any, fulfil the AO’s needs to get the lower tds approval.

- arrange the external documents to facilitate the smooth process of lower tds certificate.

- What is the service charge for obtaining the certificate?

- How do I track the status of my application?

- Is it possible to renew the certificate next year?

Need Assistance in Lower TDS?

If you are looking for lower TDS certificate, reach, Prakasha And Co, to help you to get the lower TDS within a week-time. Contact us today for a free consultancy process to obtain your Lower TDS Rate Certificate. 📧 Email: crp@prakashaandco.com 📞 Phone: +91-7019827351 📍 Location: Bangalore, KarnatakaAbove blog has been articulated with support from sr. Team at Team IN Filings, & Ms. N Janani & Mr. Mayavan MA

Like Us On Facebook

Our Client's Review

EXCELLENTTrustindex verifies that the original source of the review is Google. Best place to file ur GST n IT returns .. They respond quickly, communicate well and get ur work done as per ur needs in a very short time ..Posted onTrustindex verifies that the original source of the review is Google. Best place for Income tax filingPosted onTrustindex verifies that the original source of the review is Google. Of all the CA, CS teams I have interacted with, they are the most prompt and organized. I have taken their services for almost 3 years now for various things like income tax queries, income tax filing, networth certificates, and compliance certificates. They always display a clear understanding of the law and are also able to explain it to you in layman terms. Overall a very resourceful and courteous team. Thank you for the support!Posted onTrustindex verifies that the original source of the review is Google. Best company secretary I bangalore ever seen such quick quality servicePosted onTrustindex verifies that the original source of the review is Google. Prakasha & Co has been a lifesaver for me when it comes to my tax dispute and filings with IT office. They are always very responsive and helpful whenever I have any questions or issues, I recently had an issue with my sister business GST filings, and they were able to quickly identify the issue and help me resolve it. They really go above and beyond to make sure their clients are taken care of.Posted onTrustindex verifies that the original source of the review is Google. ''The team at Prakasha& Co made sure my company was compliant with all the legal requirements. Their attention to detail and timely response was truly remarkable."Posted onTrustindex verifies that the original source of the review is Google. "I was impressed with the level of customer service provided by Prakasha& Co. They were always available to answer my questions and provide guidance throughout the company registration process."

Important Links

- Top 10 GST Registration Consultants in Bangalore

- Top 10 Best Income Tax Lawyers in Bangalore

- Top 10 Trademark Registration Consultants in Bangalore

- GST Registration in Bangalore

- Private Limited Company Registration in Bangalore

- Partnership Firm Registration in Bangalore

- Proprietorship Registration in Bangalore

- Trademark Registration in Bangalore

- Audit Frim in Bangalore

- CA Firm in Bangalore

- Accounting Services in Bangalore

- GST Lawyers in Bangalore

- Payroll Services Provider in Bangalore

- Payroll Consultant in Bangalore

- Income Tax Lawyer in Bangalore

All Categories

- Audit

- Blogs

- Bookkeeping Services

- Company Registration

- Company secretary Legal & Chartered Accountant

- Digital Signature Certificate (DSC) Services

- FSSAI Registration and Consultation

- GST

- Income tax

- Partnership Firm Registration

- Payroll Services

- Risk Management Services

- Startup Registration Process

- Trademark Registration

- Uncategorized