Income Tax Filing: Don’t File Until 15 June

Table of Contents

ToggleDon’t File ITR in a Hurry! File correctly after 15 June

Income Tax return filing season is open. While getting your refund quickly might sound tempting, waiting a bit can save you money, time and IT notice hassle.

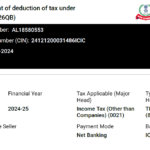

Although the Income tax filing forms are available, salaried individuals should wait to file their returns until 15 June 2024, according to a report by ITD. This is because their Annual Information Statements (AIS) and Form 26AS are typically fully updated by 31 May 2024, and salaried people receive their form-16 within 15 days from their TDS return filed, until 15th June 2024.

Why wait until 15 June to file?

Get All Your Info In One Place

While some information may start appearing in AIS and Form 26AS before 31st May 2024, the data for Dec 2024 to March 2024 is usually updated by 31 May 2024., your employer’s tax certificate (Form 16) and all your income sources on your government records (Form 26AS and AIS) are usually updated. This ensures you have everything you need for a complete and accurate return.

Don’t Miss Out on Savings

Many salaried people can claim deductions that lower their tax amount. But incomplete information can mean missing these savings! Waiting gives you time to gather documents like investment proofs or medical receipts to claim every deduction you deserve, potentially leading to a bigger refund!

Avoid Tax Headaches

Filing with incomplete information can be confusing and lead to problems later. Waiting allows for a smoother filing experience.

Remember, salaried individuals’ filing deadline for FY 2023-24 is 31 July 2024

Use this extra time to gather your documents and confidently file after 15 June 2024.

Also Read | How to file ITR online in 2024

- Sreedhara S, Back-end head from Teamindia.co.in, an income tax return filing advisory in Bangalore, explains, “Most companies, business, banks tax deductors is required to file their TDS reports by 31st May 2024 for the tax deducted in the last quarter of a financial year (between January 2024 and March 2024). Further, banks and other financial institutions must file SFT by 31 May 2024 to update the data in AIS. Hence, till the TDS return and SFT are filed, the information available on the income tax portal in AIS and Form 26AS incomplete

Why Waiting Until June 15 Benefits?

While filing your taxes early might seem convenient, waiting a little bit can ensure a smoother and more accurate filing process. Here’s why waiting until June 15 is a wise move:

- Complete Picture, Accurate Return

Consider your tax return as a report of your income for the entire year. Filing early might miss details from the last quarter (December-March). By June 15th, your employer’s tax certificate (Form 16) and government records (Form 26AS and AIS) are typically updated. This complete picture helps you avoid errors and potential problems with the tax department.

- Maximize Your Deductions, Maximize Your Refund

Many salaried individuals qualify for deductions that reduce their tax bill. But incomplete information can prevent you from claiming these deductions. Waiting gives you time to gather documents like investment proofs or medical receipts to maximize your deductions, potentially leading to a larger tax refund.

- Avoid Delays and Notices

The government receives information from banks and companies by May 31st. Filing before June 15th might mean this information hasn’t been updated yet, which can lead to delays in processing your return or even notices from the tax department. Waiting until June 15th allows everything to sync up for a smoother and more efficient filing experience.

Also, Check |Income tax return Filing service in Bangalore

- Damodharaa R Income tax expert states, “The income tax office can send notices if the information available to them in AIS & Form 26AS does not match what you have filed with ITR income tax return. The tax department will allow tax credits or income details purely on what is shown in Form 26AS/AIS. Only”

Therefore, it is crucial to ensure that the income reported in the ITR is accurate if you discover that the filed ITR is based on incorrect income information, then you can file a revised ITR by on or before 31st December 2024.

Your tax advisor should verify the tax deducted as shown in Form 16 and Form 16A is consistent with the information in AIS and Form 26AS. Any discrepancies may lead to difficulties for you as a taxpayer.

Nevertheless, it is advisable to consult your Tax advisor to file the correct and original ITR using accurate and complete income information.

some cases, like if you sure that you’re 100% know about all your income and no TDS has been deducted from your income, and you have complete information about your total income earned from various sources during the period 1st Apr 2023 to 31st March 2024, you may proceed with filing your ITR without waiting until 15th June 2024.

Necessary details and Documents for ITR Filing:

- Form 16

- Bank statement for the last 1 year

- DMAT P&L report if you are investing in shares

- Information from IT data such as Form 26AS and AIS report

- Other details which are required.

For further clarification, please reach us at Prakasha & Co.,- leading CS Legal and tax advisory services in Bangalore.

Like Us On Facebook

Our Client's Review

EXCELLENTTrustindex verifies that the original source of the review is Google. Best place to file ur GST n IT returns .. They respond quickly, communicate well and get ur work done as per ur needs in a very short time ..Trustindex verifies that the original source of the review is Google. Best place for Income tax filingTrustindex verifies that the original source of the review is Google. Of all the CA, CS teams I have interacted with, they are the most prompt and organized. I have taken their services for almost 3 years now for various things like income tax queries, income tax filing, networth certificates, and compliance certificates. They always display a clear understanding of the law and are also able to explain it to you in layman terms. Overall a very resourceful and courteous team. Thank you for the support!Trustindex verifies that the original source of the review is Google. Best company secretary I bangalore ever seen such quick quality serviceTrustindex verifies that the original source of the review is Google. Prakasha & Co has been a lifesaver for me when it comes to my tax dispute and filings with IT office. They are always very responsive and helpful whenever I have any questions or issues, I recently had an issue with my sister business GST filings, and they were able to quickly identify the issue and help me resolve it. They really go above and beyond to make sure their clients are taken care of.Trustindex verifies that the original source of the review is Google. ''The team at Prakasha& Co made sure my company was compliant with all the legal requirements. Their attention to detail and timely response was truly remarkable."Trustindex verifies that the original source of the review is Google. "I was impressed with the level of customer service provided by Prakasha& Co. They were always available to answer my questions and provide guidance throughout the company registration process."

Important Links

- Top 10 GST Registration Consultants in Bangalore

- Top 10 Best Income Tax Lawyers in Bangalore

- Top 10 Trademark Registration Consultants in Bangalore

- GST Registration in Bangalore

- Private Limited Company Registration in Bangalore

- Partnership Firm Registration in Bangalore

- Proprietorship Registration in Bangalore

- Trademark Registration in Bangalore

- Audit Frim in Bangalore

- CA Firm in Bangalore

- Accounting Services in Bangalore

- GST Lawyers in Bangalore

- Payroll Services Provider in Bangalore

- Payroll Consultant in Bangalore

- Income Tax Lawyer in Bangalore

All Categories

- Audit

- Blogs

- Bookkeeping Services

- Company Registration

- Company secretary Legal & Chartered Accountant

- Digital Signature Certificate (DSC) Services

- FSSAI Registration and Consultation

- GST

- Income tax

- Partnership Firm Registration

- Payroll Services

- Risk Management Services

- Startup Registration Process

- Trademark Registration

- Uncategorized