Form 26QB – How To Download & Fill for TDS Payment

Form 26QB – How To Download & Fill for TDS Payment— When it comes to property transactions in India, compliance with tax regulations is crucial to avoid legal hassles. One such essential requirement is the filing of Form 26QB which is used for the payment of TDS on the sale of property. This form ensures that the government receives its due share of taxes on property transactions, making it a significant part of the buying process. The demand for Form 26QB has grown significantly as property transactions have become more regulated and transparent.

With the government’s focus on controlling tax evasion, the need for accurate and timely filing of Form 26QB has never been more critical. Whether you’re a buyer or a seller, understanding how to download, fill out, and submit this form is essential to ensure compliance and avoid penalties. In this blog, Prakasha & Co., a trusted legal firm, will guide you through the entire process of Form 26QB – how to download & fill for TDS payment seamlessly. Stay connected to explore everything you need to know about Form 26QB and make your property transaction hassle-free!

Table of Contents

ToggleKey Details Required to Fill Form 26QB

Filling out Form 26QB accurately is crucial to ensure compliance with TDS regulations for property transactions. To complete the form, you’ll need to provide specific details about both the buyer and the seller, as well as information about the property being transacted. Missing or incorrect information can lead to delays or penalties, so it’s essential to have all the necessary details ready before you begin. Below is a list of key details required to fill out Form 26QB:

Buyer’s Details: PAN, name, complete address of the buyer, and their email ID and mobile number for confirmation.

Seller’s Details: PAN, name, and complete address of the seller.

Property Details:

- Address of the property being sold

- Total sale value of the property

- Date of agreement or sale

- Type of property (residential or commercial)

Payment Details: TDS amount to be deducted, mode of payment (online or offline), and Challan details.

Step-by-Step Guide to Download Form 26QB

Downloading Form 26QB is the first step in the process of filing TDS for property transactions. This form is available online on the official website of the Income Tax Department of India, making it easily accessible for taxpayers. Whether you’re a buyer or a seller, knowing how to download Form 26QB correctly is essential to ensure a smooth filing process. Below is a step-by-step guide to help you download Form 26QB effortlessly:

Step 1: Go to the official TIN-NSDL portal (https://www.tin-nsdl.com) or the Income Tax e-filing website (https://www.incometax.gov.in).

Step 2: Navigate the section related to TDS on Sale of Property or Form 26QB.

Step 3: Under the Form 26QB section, click on the link to download the form in PDF format.

Step 4: Once the form is downloaded, save it to your device for easy access.

Step 5: Ensure that the downloaded form is the latest version and is free from errors or corruption.

How to Pay TDS Using Form 26QB

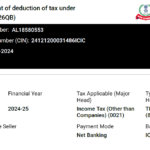

Paying TDS using Form 26QB is a critical step in property transactions, ensuring that the government receives its due taxes on the sale. The process involves filling out the form, generating a challan, and making the payment online through the designated portals. It’s essential to follow the correct steps to avoid errors and ensure timely compliance. Below is a process to help you pay TDS using Form 26QB:

- Fill Out Form 26QB: Enter all the required details, including buyer and seller information, property details, and TDS amount.

- Verify the Details: Double-check all the information entered in the form to ensure accuracy.

- Generate the Challan: After filling out the form, generate the challan for TDS payment. The challan will include details such as the payment amount and the payment reference number.

- Choose the Payment Mode: Select your preferred payment method—net banking, debit card, or credit card.

- Make the Payment: Complete the payment process using the selected mode. Ensure that the payment is successful and save the payment confirmation for future reference.

- Download the Challan Receipt: Once the payment is made, download and save the Challan receipt as proof of payment.

How Prakasha & Co. Can Assist You with Form 26QB and TDS Compliance

Navigating the complexities of TDS filing and property transactions can be challenging, especially when it comes to ensuring compliance with tax laws. At Prakasha & Co., they specialize in providing expert legal and tax advisory services to make the process seamless and stress-free for you. They will go through the entire process of downloading, filling, and submitting Form 26QB, ensuring all details are accurate and complete. Here’s how they can assist you with Form 26QB and TDS compliance:

- Expert Guidance on form 26QB

- Helps in minimizing the risk of errors that could lead to penalties or delays.

- The company is well-compliant with tax laws

- Their experts will provide quick and effective solutions.

- End-to-end support at every step of the process.

- Customized Solution to meet your specific needs.

Contact Prakasha & Co. today for expert assistance!

Phone no.: +91 7019 827 351

Email: Prakashaandco@gmail.com

Address: 188/1, Sahakarnagar, Bangalore-92

Like Us On Facebook

Our Client's Review

EXCELLENTTrustindex verifies that the original source of the review is Google. Best place to file ur GST n IT returns .. They respond quickly, communicate well and get ur work done as per ur needs in a very short time ..Posted onTrustindex verifies that the original source of the review is Google. Best place for Income tax filingPosted onTrustindex verifies that the original source of the review is Google. Of all the CA, CS teams I have interacted with, they are the most prompt and organized. I have taken their services for almost 3 years now for various things like income tax queries, income tax filing, networth certificates, and compliance certificates. They always display a clear understanding of the law and are also able to explain it to you in layman terms. Overall a very resourceful and courteous team. Thank you for the support!Posted onTrustindex verifies that the original source of the review is Google. Best company secretary I bangalore ever seen such quick quality servicePosted onTrustindex verifies that the original source of the review is Google. Prakasha & Co has been a lifesaver for me when it comes to my tax dispute and filings with IT office. They are always very responsive and helpful whenever I have any questions or issues, I recently had an issue with my sister business GST filings, and they were able to quickly identify the issue and help me resolve it. They really go above and beyond to make sure their clients are taken care of.Posted onTrustindex verifies that the original source of the review is Google. ''The team at Prakasha& Co made sure my company was compliant with all the legal requirements. Their attention to detail and timely response was truly remarkable."Posted onTrustindex verifies that the original source of the review is Google. "I was impressed with the level of customer service provided by Prakasha& Co. They were always available to answer my questions and provide guidance throughout the company registration process."

Important Links

- Top 10 GST Registration Consultants in Bangalore

- Top 10 Best Income Tax Lawyers in Bangalore

- Top 10 Trademark Registration Consultants in Bangalore

- GST Registration in Bangalore

- Private Limited Company Registration in Bangalore

- Partnership Firm Registration in Bangalore

- Proprietorship Registration in Bangalore

- Trademark Registration in Bangalore

- Audit Frim in Bangalore

- CA Firm in Bangalore

- Accounting Services in Bangalore

- GST Lawyers in Bangalore

- Payroll Services Provider in Bangalore

- Payroll Consultant in Bangalore

- Income Tax Lawyer in Bangalore

All Categories

- Audit

- Blogs

- Bookkeeping Services

- Company Registration

- Company secretary Legal & Chartered Accountant

- Digital Signature Certificate (DSC) Services

- FSSAI Registration and Consultation

- GST

- Income tax

- Partnership Firm Registration

- Payroll Services

- Risk Management Services

- Startup Registration Process

- Trademark Registration

- Uncategorized